Business Entertainment Deductions 2025 - Entertainment Tax Deduction 2025 Janice Olympie, If you own a business, you may be able to take the meals and entertainment. Business Entertainment Deductions 2025. Entertainment expenses are tricky, but there are a few instances where the ato. These final regulations bring clarity for the business community on what food and.

Entertainment Tax Deduction 2025 Janice Olympie, If you own a business, you may be able to take the meals and entertainment.

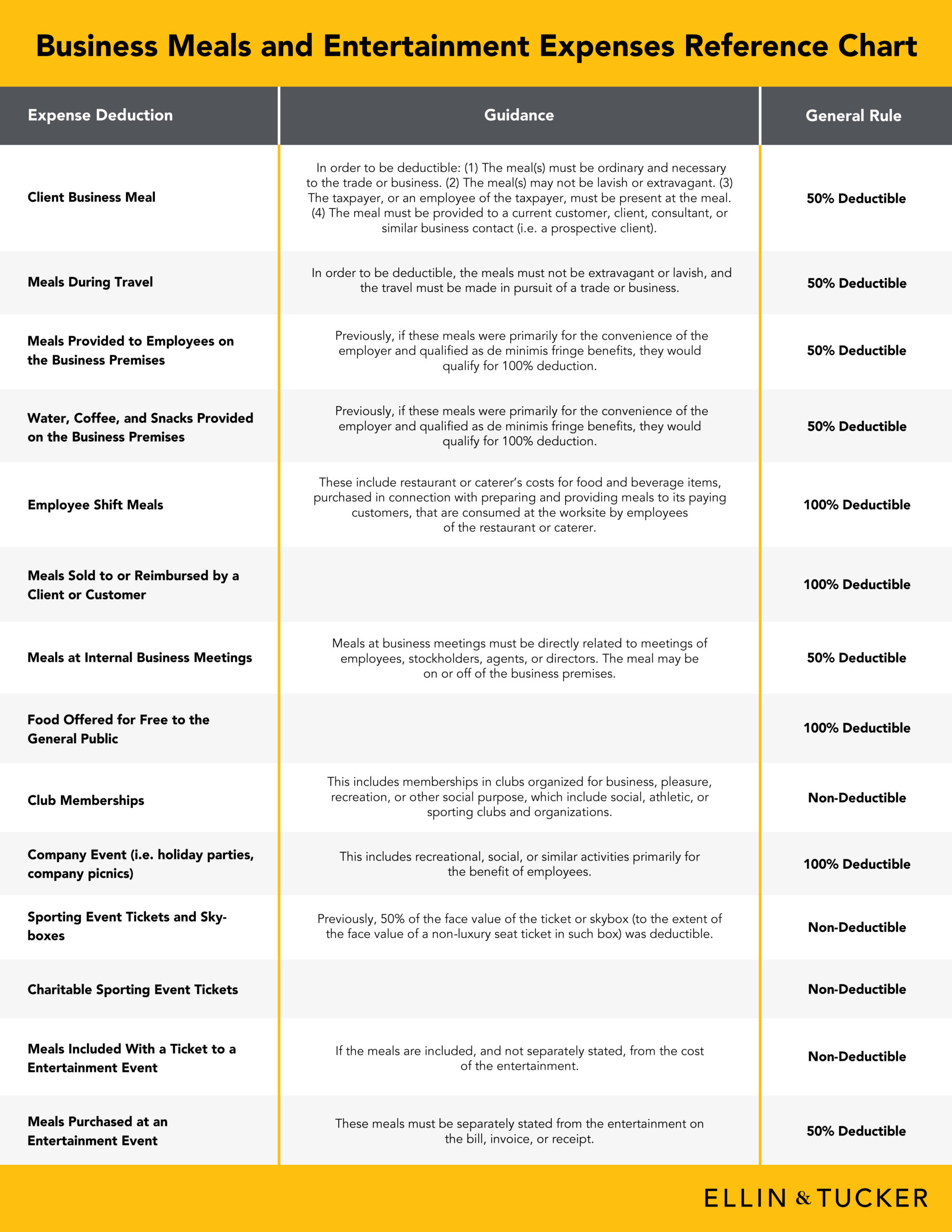

Check, Please Deductions for Business Meals and Entertainment Expenses, Subject to limited exceptions, deductions are denied for expenditure on.

May 2025 Calendar Png. Find & download free graphic resources…

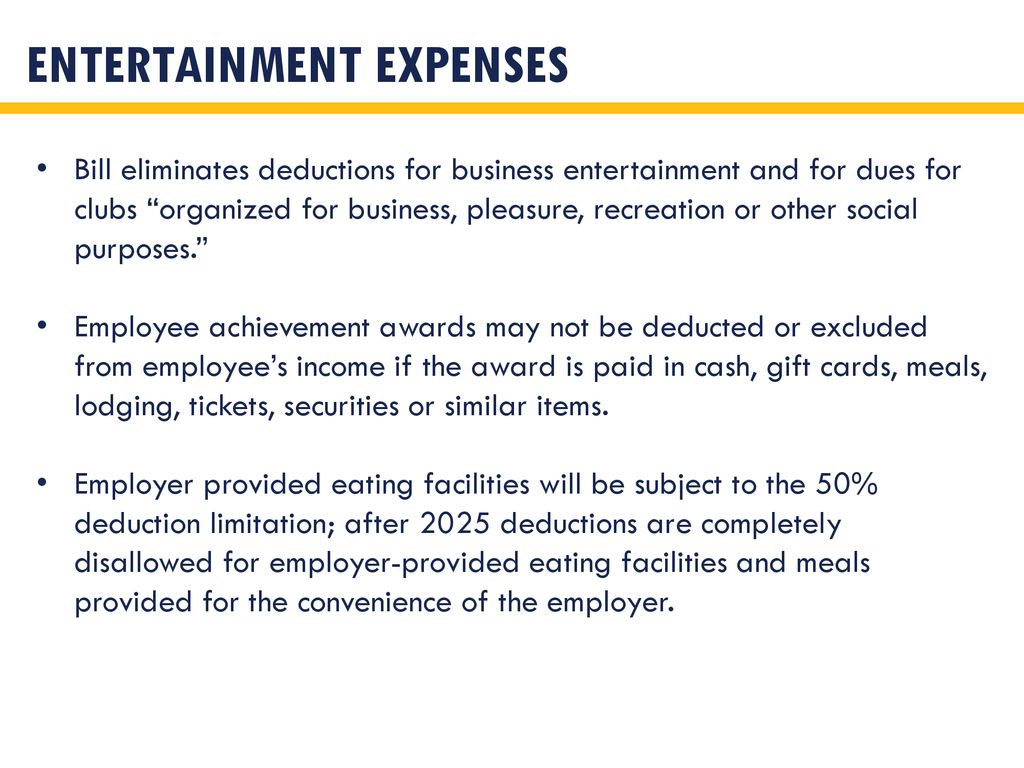

The tax cuts and jobs act ppt download, Friday discusses the significant tax changes set to take.

2025 Mustang Colors. Race red, vapor blue and wimbledon white.…

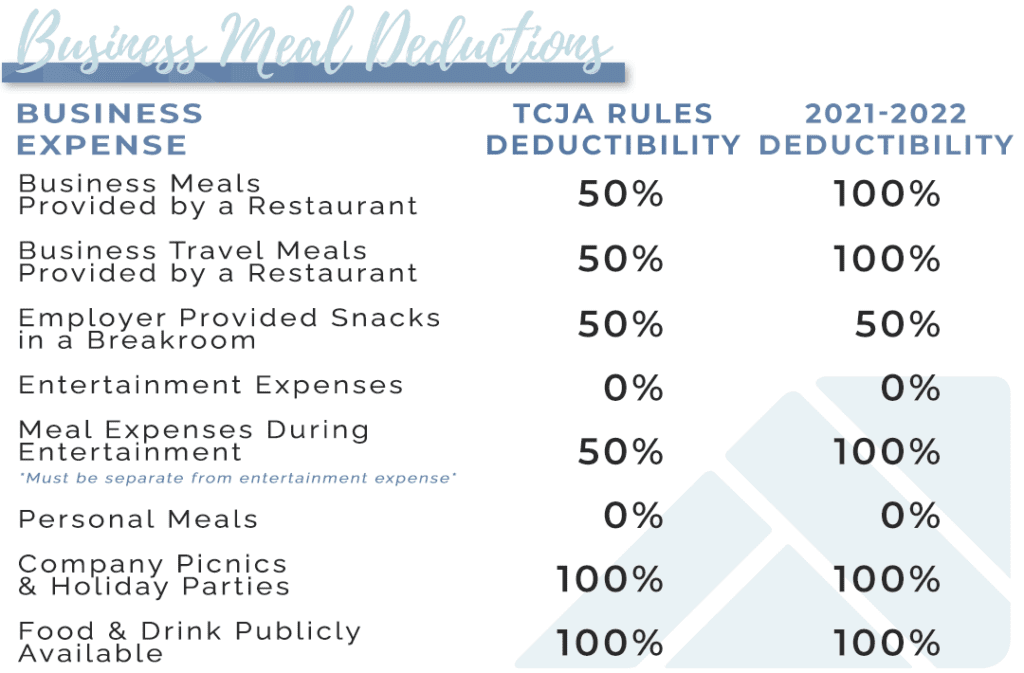

Meals and Entertainment Deductions 50 vs. 100 Explained, With limited exceptions relating to travel and overtime, the cost of food and drink is private and not.

Meals and Entertainment Deduction Shay CPA, If you own a business, you may be able to take the meals and entertainment.

You can’t claim the cost of attending functions or participating in entertainment. Discover how the 2025 tax policy changes can benefit small business owners.

Final Tax Regulations on Entertainment and Meals as Business Deductions, Business meals are generally deductible business expenses if the taxpayer.

Is Business Entertainment Deductible In 2025 Drona Ginevra, Due to the complex nature of the interaction between fbt, tax deductibility and.

Wsu Dads Weekend 2025. All wsu departments, living groups, student…